SAP Financial Supply Chain Management

(FSCM) is a set of programming tools and procedures intended to upgrade an

association's product flow, maximizing productivity and limiting costs. It

enhances the Financial and data streams inside a Company and Business Partners.

SAP Financials is comprehensively composed in 4 expansive usefulness areas to

help all money related administration forms and joining with different business

forms:

1. Financial and

Management Accounting

2. Financial Supply Chain

Management

3. Treasury and Risk

Management

4. Corporate Governance

|

SAP FSCM |

SAP

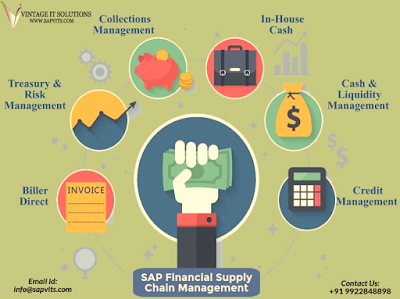

Financial Supply Chain Management FSCM contains the following key points:

1. SAP Treasury and Risk

Management (FIN-FSCM-TRM),

2. SAP Biller Direct

(FIN-FSCM-BD),

3. SAP Cash and Liquidity

Management (FIN-FSCM-CLM),

4. SAP Collections

Management (FIN-FSCM-COL),

5. SAP Credit Management

(FIN-FSCM-CR),

6. SAP Dispute Management

(FIN-FSCM-DM)

7. SAP In-House Cash

(FIN-FSCM-IHC)

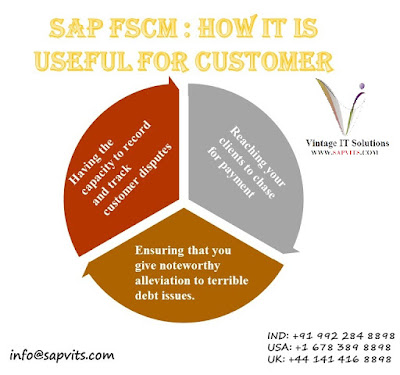

SAP FSCM – How useful to customer

To understand the

business process is a prime factor for learning any SAP module. Some business

issues will explain how SAP FSCM is helpful to customer:

1. Reaching your clients

to chase for payment.

2. Having the capacity to

record and track customer disputes.

3. Ensuring that you give

noteworthy alleviation to terrible debt issues.

|

SAP FSCM: Use of Customer |

Reaching your clients to chase for payment

Organization that have a

lots of customer. This requires a

group of "cash collector" to call clients to chase for payments. This

could be professional dynamic calling guaranteeing the required payment will be

met, or pursuing obligation that is presently past due.

Inside FSCM there is a

sub-module called "Collection Management". The number 1 advantage, is

that it gives the cash collectors an organized work rundown of clients for them

to call. The work-list is characterized through various measures that are

characterized by means of design. This gives an association an organized

procedure to handle the money gathering process. Further to this, the client

can include notes around the call with the client, record a guarantee to pay

and raise a question that a client has raised.

Having the capacity to record and

track customer disputes

The second zone is the

logging and determination of client raised disputes. As specified previously,

there are various reasons why a client could raise a disputes against an

invoice or group of invoices. An effective procedure is required to log clients

question and guarantee the right individual inside an association has

perceivability of that debate so it can be settled.

"Dispute

Management" is the sub module inside FSCM to handle this. A SAP case

record is made to catch the dispute data. Different clients can be assigned to

a dispute to process or resolve the question. Further to this dispute creation

can be robotized, work process can be utilized to guarantee the right

individual is passed the right question dependent on the reason of the dispute,

kind of client and so on. By designing & implementing a proficient dispute

management solution in ERP 6 guarantees that the clients can pay more

solicitations in a speedier time decreasing the esteem and volume of unpaid

past due invoices.

Ensuring that you give significant

mitigation for bad debt issues

The keep going zone

centers around the credit furthest reaches that you give your clients. There is

no point offering a client an item for say $100,000 in the event that they

can't bear to pay for that. This will prompt a bad debt where you should "discount"

the way that the client can't bear to pay for your item. In the meantime, where

a client is a decent payer, and they are developing you might need to expand

their credit confine so they can purchase more, and you sell more to them.

The conventional SAP

solution for credit management was genuinely manual. You would take information

from outsider frameworks that gave a FICO assessment against a client. This

depended on how that client was seen as a payer against various different

associations. This data while valuable does not give exact data to your

Organization, as you are constructing their paying force based with respect to

different Organizations. Inside FSCM Credit Management the fundamental

advantage, is that you can make your own particular tenets to ascertain a FICO

assessment against a client. This can be founded on various variables, inside

and outside. You can even now utilize the outside financial assessment, however

you can likewise perceive how well that client pays you, what their present credit

introduction is and the deals the client has made previously. This gives you

more applicable credit data for you, enabling you to settle on a superior more

educated choice while allowing a credit point of confinement to a client.

What we promise at SAPVITS

1) We offer convenient

batches and timings for the classes are arranged upon the flexibility of both

the Trainee and the Trainer according to their availability.

2) We offer free online

demo session, Trainee can attend the demo session, asses the Trainer and after

that join the course.

3) We offer excellent

course material and also share project scenarios which are like what you work

when you go to the corporate environment.

4) We share recorded

videos of each training session so that you can review them later as well. The

videos created by experts make it easier for the learning professionals.

Contact Us:

Vintage

IT Solutions

IND: +91 992 284 8898

USA: +1 678 389 8898

UK: +44 141 416 8898

No comments:

Post a Comment